Catalyze your growth with our innovative features

Catalyze your

growth with

our innovative

features

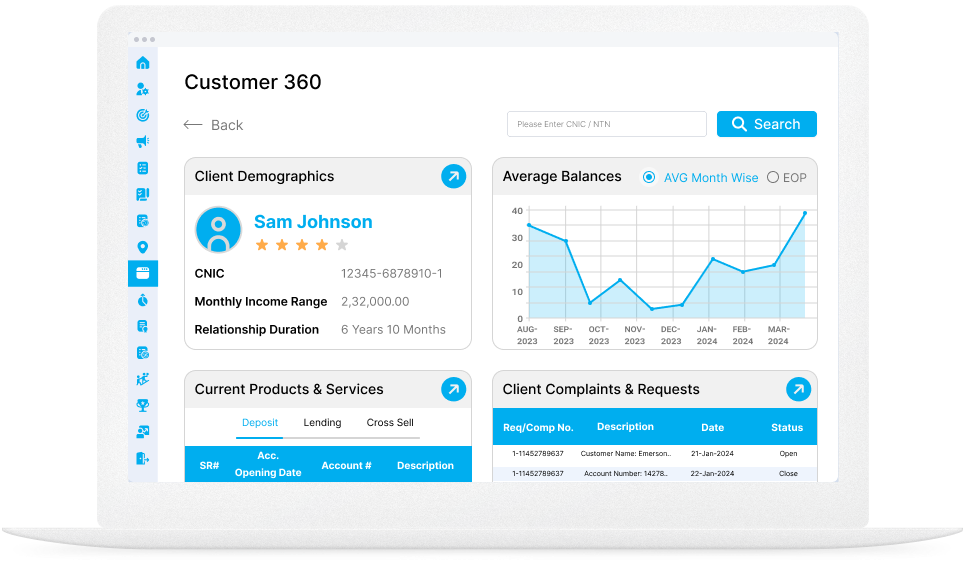

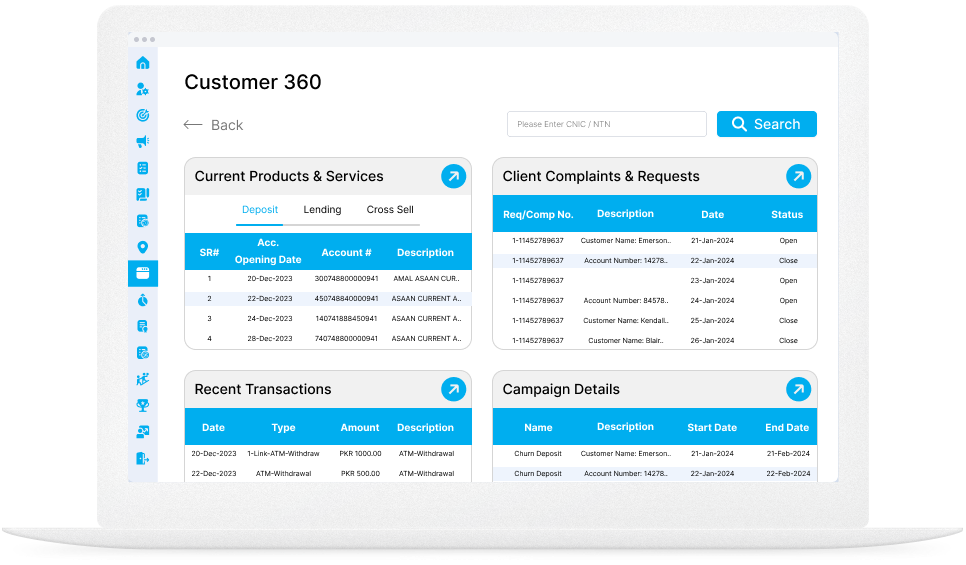

Customer 360

Get a 360-degree view of each individual customer or account with our Customer 360 feature. It gathers data from multiple sources, compiles

it in one place, and presents it in an easy-to-consume manner, providing every user of the product with an in-depth view of a customer’s account history and preferences.

Use Cases

Customer

Personalization

Connect360 empowers banks to deliver tailored experiences by leveraging customer profiling, multi-platform data synchronization,

and a Customer 360 dashboard.

Manage Cash Flow and

Prevent Cash Loss

Efficient cash management is crucial in the banking industry to maximize operational efficiency and ensure customer satisfaction. Connect360, equipped with AI predictive models, enhances cash management by providing valuable insights and forecasts.

Predict Customer

Lifetime Value

Connect360 offers features such as activity trackers and lead management dashboards to optimize prospecting efforts. It also facilitates collaboration among sales teams.

Track And Prevent

Attrition

For all financial institutions, tracking churn and managing customer retention are crucial for growth and profitability. Connect360 equips banks with powerful features

to address these needs.

Prioritize High Value

Customers

For banks, prioritizing leads and optimizing conversion rates are crucial for revenue growth.

A tailored Connect360 solution can streamline lead management and enhance

conversion opportunities.

Run Auto-Triggered Campaigns

To Reduce Dormancy

Efficiently onboarding new clients is crucial

in the competitive banking industry. Connect360 revolutionizes client

onboarding by leveraging advanced lead capture techniques.

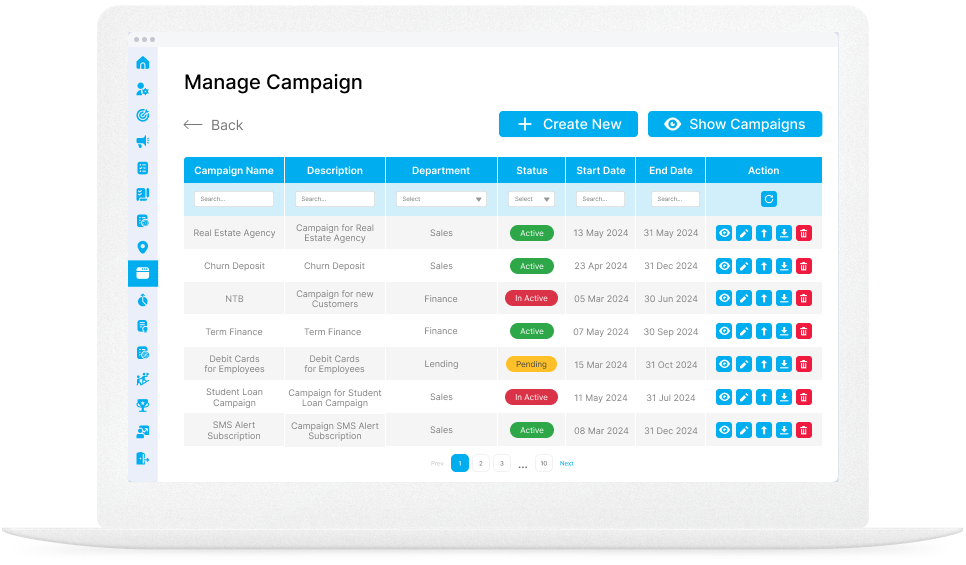

Campaign Management

Manage campaigns efficiently. Add client details, assign resources, and track progress easily.

Daily Activity Report

Uncover sales patterns and opportunities. Track lead performance and identify top performers.

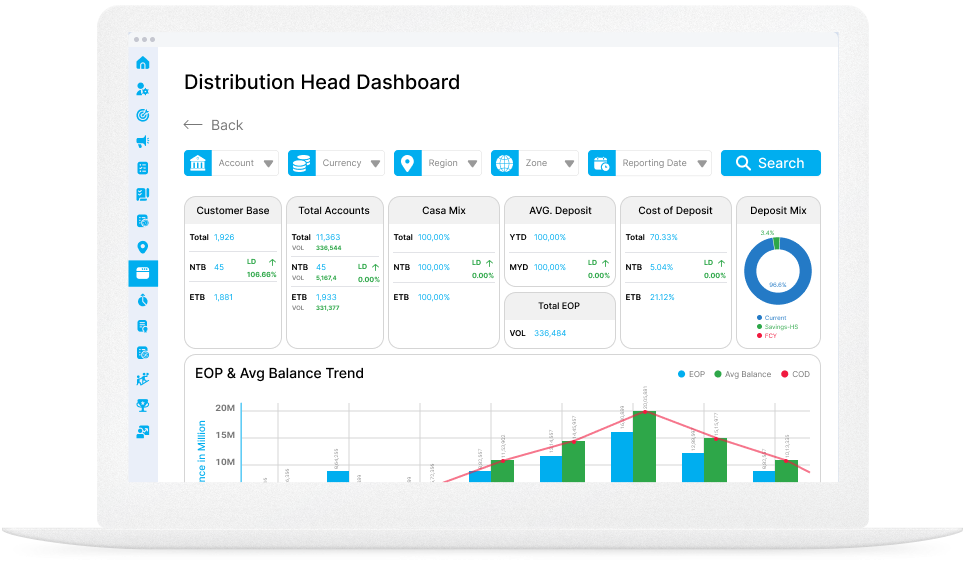

Performance Management

Monitor sales targets and performance. Analyze new clients onboarded, deposit trends, and cross-sell opportunities.

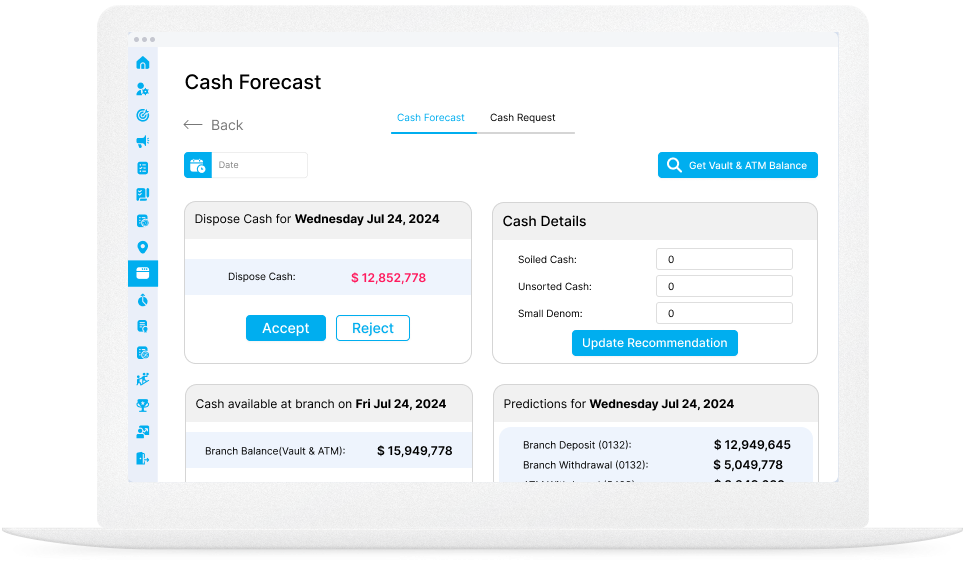

Cash Optimization

Predict cash demand branch-wise. Optimize cash usage and address shortages or surpluses effectively.

Mentorship & Training

Stay updated on team performance. Measure performance against targets and provide mentorship and training as needed.

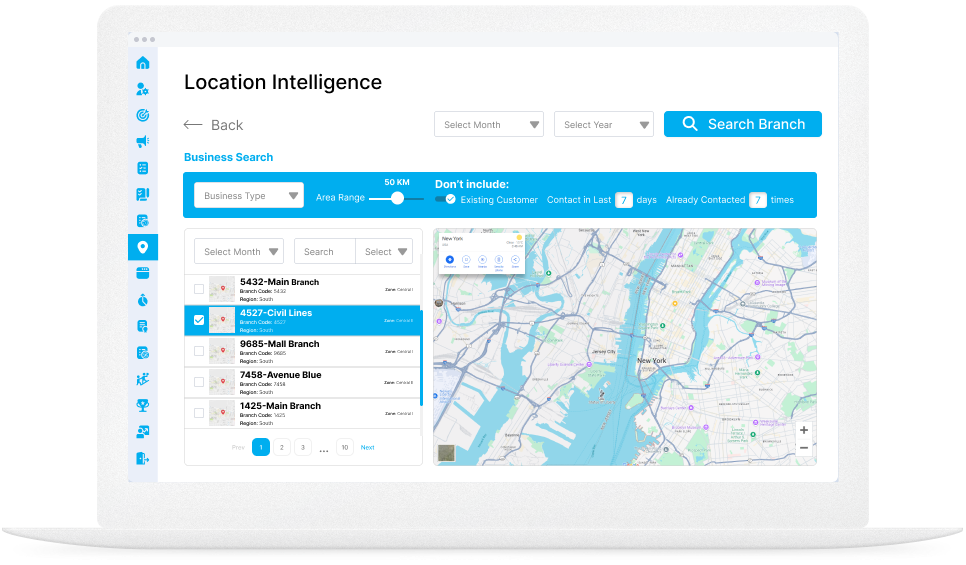

Branch Management

Efficiently manage branches and activities. Gain visibility into branch productivity and growth trajectory.

- Stamford, Soundview Plaza, Suite 700R, 1266 E Main St. Stamford Connecticut 06902

- +1 416 8068501

- info@connect360.tenx.ai